CPI-based inflation rate fell to 4.87 percent in October: Basics Explained

As per the data released by the National Statistical Office (NSO) India’s consumer price index (CPI)-based inflation rate fell to 4.87 percent in October (it was 5.02 percent in September). Food inflation, which accounts for nearly half of the overall consumer price basket, rose 6.61% in October as compared with 6.56% in September.

CPI-based inflation in October was below the Reserve Bank of India’s (RBI) upper tolerance band of 4-6% for a second consecutive month but the central bank last month kept its key lending rate steady for a fourth consecutive policy meeting and said it remains focused on bringing inflation close to the target of 4%.

LEARNING FROM HOME/ WITHOUT CLASSES/ BASICS

Consumer Price Index(CPI) looks at the price at which the consumer buys goods, the Wholesale Price Index(WPI) tracks prices at the wholesale, or factory gate/mandi levels.

WPI only tracks basic prices devoid of transportation costs, taxes the retail margin, etc. And that WPI pertains to only goods, not services.

The CPI is a measure that assesses the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care, purchased by households.

The Difference between WPI and CPI

| WPI | CPI |

| Calculates the average change in prices of commodities at the wholesale level.( First stage of a transaction) | At the retail level.( Final stage of a transaction) |

| Data published By: Office of Economic Advisor (Ministry of Commerce & Industry) | Central Statistics Office (Ministry of Statistics and Programme Implementation) & Labour Bureau |

| Covers Goods only | Goods and Services both |

| Manufacturers and wholesalers (Producer Level) | Consumers (Consumer Level) |

| Manufacturing inputs and intermediate goods like minerals, machinery basic metals, etc. | Education, communication, transportation, recreation, apparel, foods and beverages, housing and medical care |

| Base Year:2011-12 | 2012 |

In April 2014, the RBI had adopted the CPI as its key measure of inflation.( Urjit R. Patel Committee report recommendations

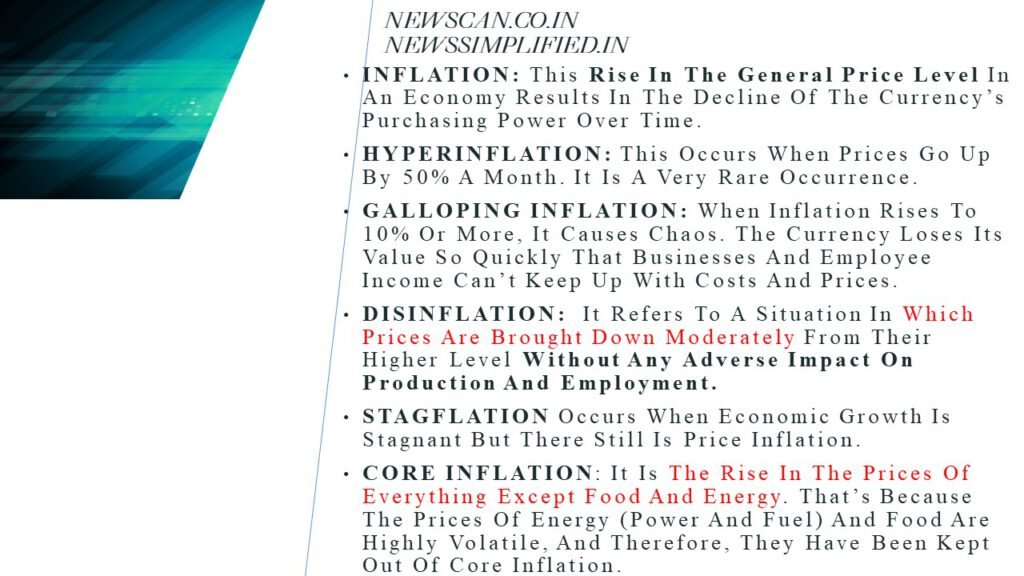

INFLATION: It is an economic condition in which prices of goods and services rises and value of money falls or money circulation exceeds the production of goods and services.

DISINFLATION: It refers to a situation in which prices are brought down moderately from its higher level without any adverse impact on production and

0 Comments