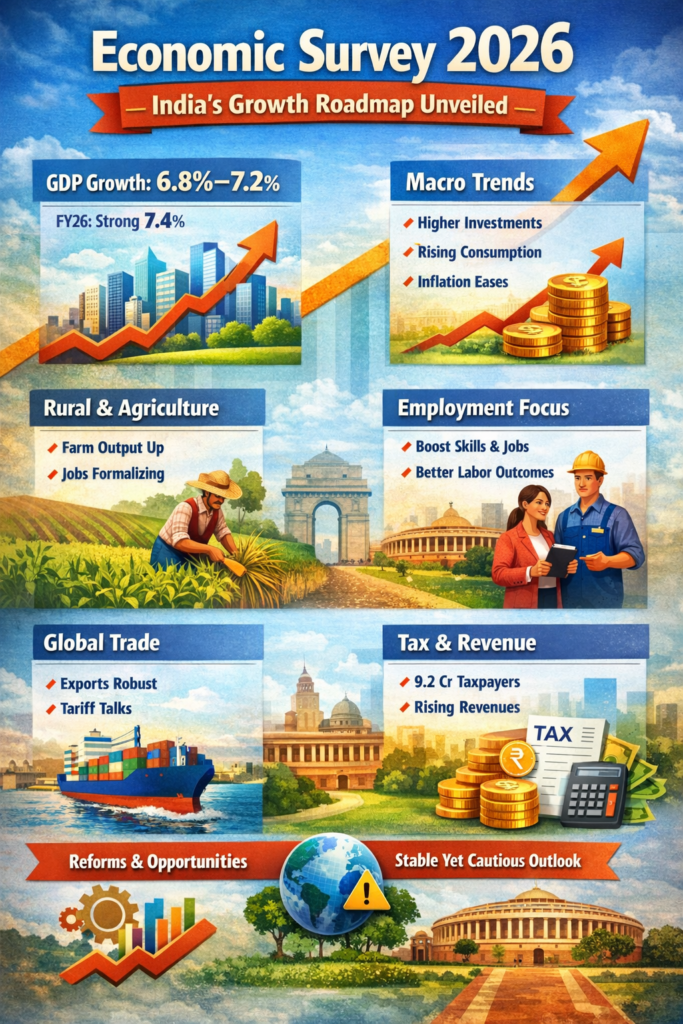

Economic Survey Tracks Progress and Flags Key Risks

The Economic Survey is an annual economic report. The Government of India tables it in Parliament before the Union Budget. It assesses macro-economic trends and sets the budget context.

The Economic Survey reviews the economy’s performance in the past year. At the same time, it identifies key challenges. It also highlights future opportunities.

Moreover, the Survey analyses growth, inflation, jobs, and fiscal health. It relies on data and evidence. Importantly, it does not announce policies. Instead, it guides policy thinking. Overall, the Economic Survey links economic review with fiscal planning. Consequently, it helps stakeholders understand the economic direction.

Survey sets stage for Budget on 1 Feb.

AI GENERATED IMAGE

THE ECONOMIC SURVEY PROJECTED

Growth & Outlook

- GDP forecast: FY27 growth 6.8 %–7.2 %.

- FY26 growth at 7.4 %.

- Outlook: Stable overall, but global risks persist.

Macro Trends

- Private consumption expanded, boosting GDP share.

- Public and Private capital drives investment activity.

- Inflation moderated with supportive monetary stance.

- Fiscal deficit on track, but vigilance needed.

Agriculture & Rural Economy

- Farm outputs up. Rural demand improving.

- MGNREGS reliance down; rural jobs shifting to formal work.

Employment & Skills

- Formal skilling can boost jobs ~13 %.

- GDP linked to better labor outcomes and skill reforms.

External Sector & Trade

- Exports stronger even with global tariffs.

- Trade deals and tariff issues highlighted.

- AI investment risks noted due to global finance patterns.

Tax & Revenue

- Tax base wider: 9.2 crore taxpayers now.

- Revenue share rising in GDP.

Structural Reforms

- Tax cuts on debt instruments recommended to lower capital cost.

- Activity-based regulation urged to avoid arbitrage.

- Growth capacity seen near 7 % medium term due to reforms.

Sector Highlights

- Services & manufacturing drive output growth.

- Infrastructure networks (roads, rails) expanded.

- GST revenue growth reflects economic activity.

RISKS

- Global uncertainty remains high. Therefore, growth faces external shocks.

- Geopolitical tensions disrupt trade routes. As a result, costs can rise.

- Financial market volatility may affect capital flows. Hence, caution is needed.

- Climate risks threaten agriculture output. Consequently, rural incomes may fluctuate.

- Inflation resurgence remains a concern. Thus, policy balance is critical.

- Private investment hesitation can slow momentum. However, reforms can offset this.

- Technology and AI concentration may raise inequality risks. Therefore, skills matter.

- Fiscal pressures need discipline. Otherwise, debt sustainability weakens.

0 Comments