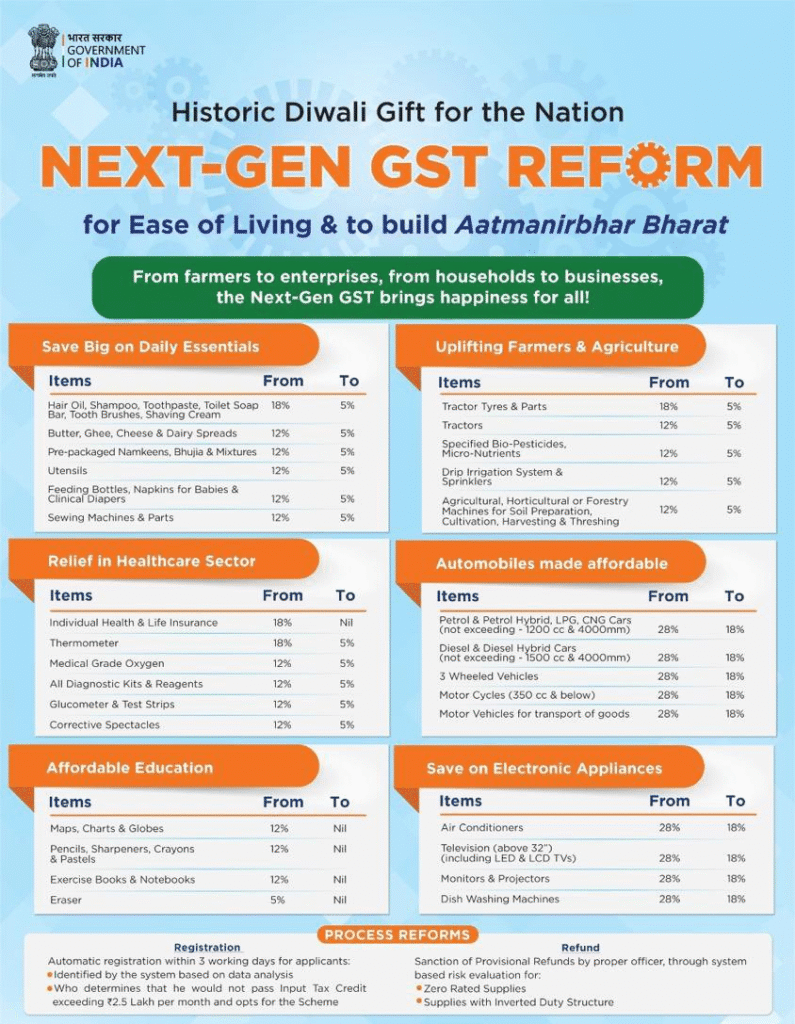

Rationalisation of GST Rate

The government has rationalized the GST rate slabs into a dual-rate structure. It shifted to a two-slab system of 5% and 18%, removing the earlier 12% and 28% rates. The government also imposed a 40% tax on luxury and sin goods, such as pan masala and tobacco,high-end cars.

LEARNING FROM HOMES/ WITHOUT CLASSES/BASICS

Introduced on 1st July 2017.The concept of “one nation, one tax”. Eliminating cascading of taxes — that is, tax on tax. It is a tax levied when a consumer buys a good or service. GST will bring a unified, unfragmented national market for goods and services. It will enhance the ease of doing business. It will make our producers more competitive against imports by eliminating multiple points of taxation, and multiple jurisdictions.

Officially, the Constitution (One Hundred and Twenty-Second Amendment) Bill 2014.

- The Bill seeks to amend the Constitution. Will introduce a goods and services tax. Which will subsumes various Central indirect taxes, including the Central Excise Duty, Countervailing Duty, Service Tax, etc. It also subsumes State value added tax (VAT), octroi and entry tax, luxury tax, etc.

- The Bill seeks to establish a GST Council tasked with optimising tax collection for goods and services by the State and Centre. The Council will consist of the Union Finance Minister (as Chairman), the Union Minister of State in charge of revenue or Finance, and the Minister in charge of Finance or Taxation or any other, nominated by each State government

The Council will be the body that decides which taxes levied by the Centre, States and local bodies will go into the GST. which goods and services will be subjected to GST. and the basis and the rates at which GST will be applied. - Under the Bill, alcoholic liquor for human consumption is exempted from GST. Also, it will be up to the Council to decide when GST would be levied on various categories of fuel, including crude oil and petrol.

0 Comments