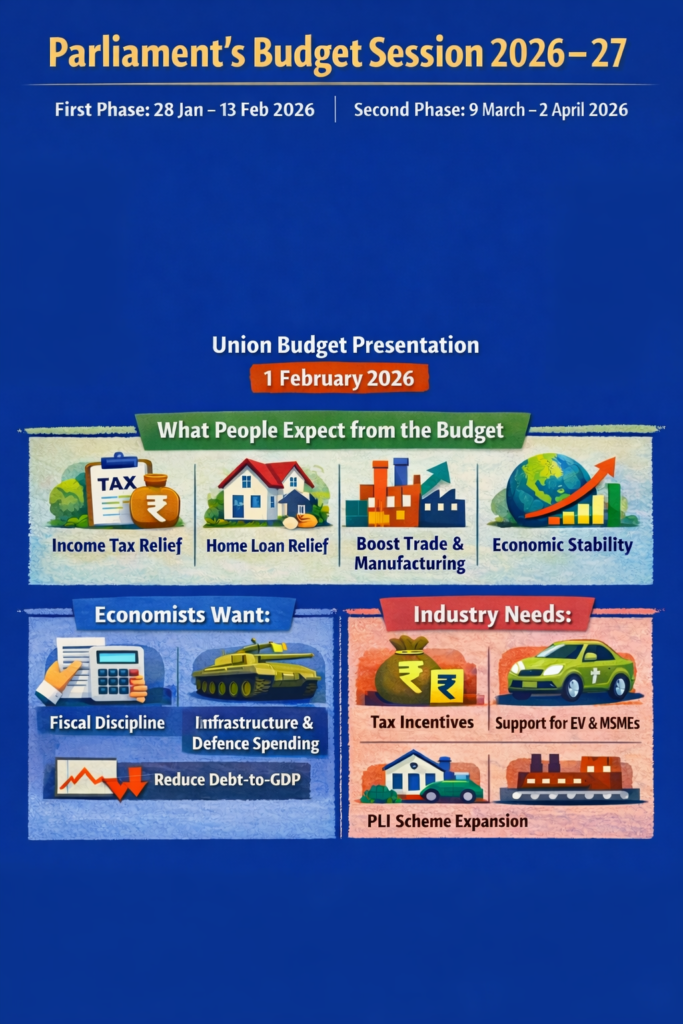

Parliament’s Budget Session People expectations

Parliament’s Budget Session for 2026–27 begins today, 28 January 2026. The session will open with an address by President Droupadi Murmu to a joint sitting of the Lok Sabha and the Rajya Sabha.

The Budget Session will continue till 2 April 2026 and will take place in two phases.

- First Phase: 28 January to 13 February

- Second Phase: 9 March to 2 April

AI GENERATED PICTURE

Key Focus of the Session

During this session, Parliament will mainly debate the Union Budget, finance proposals, taxation matters, public spending, and key government policies.

The Union Budget will be presented on 1 February 2026 by the Finance Minister.

All-Party Meeting Before the Session

The Government held the customary all-party meeting on 27 January 2026. Defence Minister Rajnath Singh chaired the meeting.

Leaders from different political parties discussed issues likely to come up during the session. Opposition parties flagged several concerns they plan to raise in Parliament, including:

- MGNREGA and its proposed replacement through the VB–GRAM G Bill

- Special Intensive Revision (SIR) of voter lists and related electoral issues

- Problems in agricultural procurement and farmers’ distress

- Unemployment, environmental challenges, law and order issues, and foreign policy concerns

The Government called for cooperation from all parties to ensure smooth proceedings. It stressed that Parliament should focus mainly on Budget-related financial business and legislative priorities.

What People Expect from the Budget

People across the country expect the Budget to provide:

- Income tax relief, especially for salaried and middle-class taxpayers

- Simpler tax rules to promote trade and manufacturing

- Home loan relief to support housing and middle-class families

- Steps to strengthen the economy amid global uncertainties

What Economists Expect

Economists expect the Government to:

- Continue fiscal discipline while supporting economic growth

- Control the fiscal deficit without cutting essential spending

- Increase spending on infrastructure and defence

- Push structural reforms to attract investment

- Work towards reducing the debt-to-GDP ratio

Industry Expectations

Industry groups are looking for:

- Tax incentives and measures to boost demand

- Special support for the automobile and EV sectors

- Higher capital expenditure on infrastructure

- Stronger support for MSMEs

- Expansion of the Production Linked Incentive (PLI) scheme to more products

READ FOR BUDGET SESSION CONSTITUTIONAL PROVISIONS

India’s Budget Session : Understanding Its Constitutional Framework – News Simplified

0 Comments