IMF relabel India’s exchange rate from floating to stabilize

IMF (The International Monetary Fund) has reclassified India’s “de facto” exchange rate regime to “stabilized arrangement” from “floating” for December 2022 to October 2023, According to the IMF’s staff assessment, forex intervention by the Reserve Bank of India likely exceeded levels necessary to address disorderly market conditions and has contributed to the rupee-dollar moving within a narrow range since December 2022.

LEARNING FROM HOME/ WITHOUT CLASSES/ BASICS

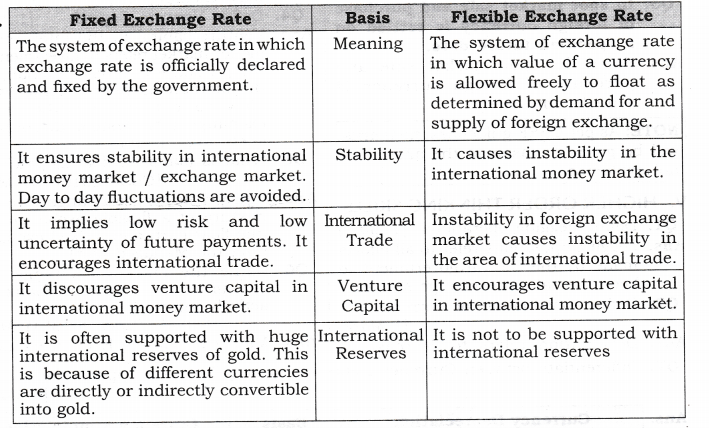

An exchange rate is a rate at which one currency will be exchanged for another currency and affects trade and the movement of money between countries. Most exchange rates are defined as floating and will rise or fall based on the supply and demand in the market. Some exchange rates are pegged or fixed to the value of a specific country’s currency.

The real exchange rate is the exchange rate between countries that takes into account the price level between these countries. The main aim of the real exchange rate is to capture and show how much change there is in purchasing power between countries when price levels are also taken into account.

Foreign exchange reserves are assets denominated in a foreign currency that are held by a central bank.

Forex reserves are external assets in the form of gold, SDRs (special drawing rights of the International Monetary Fund ) and foreign currency assets (capital inflows to the capital markets, FDI and external commercial borrowings) accumulated by India and controlled by the RBI.

In India, the Reserve Bank of India Act 1934 contains the enabling provisions for the RBI to act as the custodian of foreign reserves, and manage reserves with defined objectives

Foreign exchange reserves are the foreign currencies held by a country’s central bank. A strong position in foreign currency reserves can prevent economic crises caused when an event triggers a flight to the foreign currency from the domestic market. They are called reserved assets in Balance of Payments and are located in capital account.

- The most important reason to have a reserve is to manage one’s currency values. They are usually used for backing the exchange rate and influencing monetary policy.

- Reserves are always needed to make sure a country will meet its external obligations. These include international payment obligations, including sovereign and commercial debts. They also include financing of imports and the ability to absorb any unexpected capital movements.

1 . The most significant objective behind this is to ensure that RBI has backup funds if their national currency rapidly devalues or becomes altogether insolvent.

- If the value of the Rupee decreases due to an increase in demand of the foreign currency then RBI sells the dollar in the Indian money market so that depreciation of the Indian currency can be checked.

- A country with a good stock of forex has a good image at the international level because the trading countries can be sure about their payments.

- A good forex reserve helps in attracting foreign trade and earns a good reputation in trading partners.

The High Level Committee on Balance of Payments (Chairman: C. Rangarajan), 1993, had Foreign exchange reserves are the foreign currencies held by a country’s central bank. A strong position in foreign currency reserves can prevent economic crises caused when an event triggers a flight to the foreign currency from the domestic market. They are called reserved assets in Balance of Payments and are located in capital account.

A capital account keeps a record of all the transactions related to assets between India and other countries. This includes all kinds of investment assets like shares, debt, and property, or even corporate assets.

The International Monetary Fund (IMF) was created, Bretton Woods Conference, in the wake of World War II to manage the global regime of exchange rates and international payments. Since the collapse of fixed exchange rates in 1973, the fund has taken a more active role, especially in developing countries. Unlike the World Bank, which was designed as a lending institution focused on longer-term development and social projects, the IMF was conceived as a watchdog of the monetary and exchange rate policies vital to global markets.

0 Comments